Mathini Ilancheran, principal analyst, R&D, Beroe Inc. Published in Clinical Leader, May 5, 2022

The clinical trial staffing market is a high-margin market due to the increasing numbers of clinical trials globally and the high demand for resources. Clinical staffing companies offer varying flexible options to suit sponsors’ requirements, ranging from insourcing to functional service outsourcing, including hybrid models. CROs are traditionally the suppliers of choice due to their clinical expertise, global reach, and high scalability. However, with the ongoing shortage of CRAs and those in other clinical operations roles, it is important for pharma companies to understand the various trends out there and how technology providers can help them tackle the attrition problem and manage the growing demand for clinical trial staff.

Market Trends

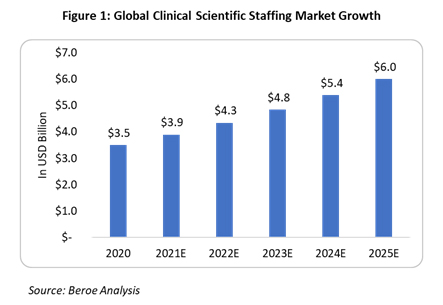

The global clinical staffing market is expected to be $7.03 billion in 2022 and grow at approximately 7.5 to 8% CAGR through the 2020-2026 period (Figure 1). The increasing complexity of trial protocols, study procedures, trial design, and volunteer recruitment, as well as the globalization of clinical trials demanding regional regulatory compliance, are the major factors driving the market.

Some of the key trends within the clinical staffing industry are as follows:

- War for Talent: Pharmaceutical companies are balancing between an overall cost reduction objective and rising FTE rates. Shorter contract terms at a gradually growing FTE rate are observed to manage risk. This is due to CROs paying high salaries along with performance bonuses to retain talent. The war for talent is expected to heat up, creating further demand for CRAs. CROs will continue to pay premiums to retain talent.

- CRA Shortage: There’s a huge supply-demand gap for clinical talent, a challenge largely of the industry’s own making. The average total turnover rate for CRAs is roughly 20%, and 48% of CRAs stay in their positions for one to two years before changing jobs. Salary expectations, the need for higher compensation, and lack of a clear career path are some of the reasons for this high attrition.1

- Use of Digital Technology to Grow: Though digital technology has been making some noise in the industry, the current COVID-19 pandemic has forced companies to experiment with digital and other innovative/disruptive means of service offerings to ensure process continuity.

Telehealth is being used by healthcare organizations and practitioners for talent acquisition and finding jobs.2 Natural language programming is being explored for automating processes, like analyzing resumes and feedback forms without human bias. Predictive analysis and AI are also being utilized by several staffing firms for hiring and recruitment.

- Resource Management Platforms to Source Candidates: Virtual applications are becoming vital for performing various processes of clinical staffing, such as licensure, credentialing, recruitment, interviewing, placement, and onboarding.

Remote patient monitoring tools are also creating a shift in the CRA skillset and are creating demand for technology-enabled processes for quicker and efficient staffing.

With the ongoing shortage of clinical trial staff, new technology has emerged that can help in sourcing, training, and deploying new talent to the clinical research industry. This could help manage the supply-demand gap and ongoing shortages. For example, Virb’s Digital Platform acts as a seamless automated workflow for the entire value chain, from community engagement to placement and post placement.3 More such platforms will be seen in the future as pharma companies struggle to retain talent and address the rising FTE rates.

Supply And Demand Outlook

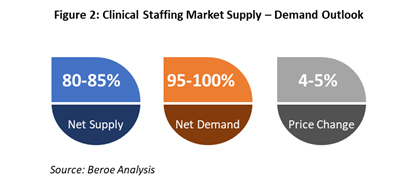

With the world dealing with the pandemic, 57% of patient interactions and 79% of interactions between sponsors and CROs are taking place remotely.4 This has led to changes in roles and responsibilities of clinical staff. CRAs and investigators need to enhance their skillsets and become adapted to technologies to sustain their careers and remain competitive. This may lead to a shift to training new talent directly from universities and hiring them, as an alternative to pharma’s current preference for only hiring experienced candidates. Figure 2 below shows the current outlook of the clinical staffing market.

Supply trend: The current situation has depleted the available clinical resources and caused all the major suppliers to add effort to accommodate COVID trials in their existing trial pipelines. Staffing specialists are being approached to help find resources for conducting trials to manage the shortage and minimize delays.

Demand trend: New COVID-19 trials led to an increase in the total number of trials, hence the increase in the number of overall pipeline trials and the need for resources. CRA turnover in the U.S. has reached close to 20%,5 and a similar issue is being witnessed across other job roles. Hence, demand for clinical staffing is expected to grow at a high rate for the next two to three years.

Price Trend: With the shift in the industry to source regionally to avoid further delays, the supplier market looks very competitive. The availability of clinical staff with remote work experience and technical know-how is low, hence billing rates have increased due to high demand.

Conclusion

To summarize, the major challenges faced by pharma companies and staffing companies is the assurance of supply, retention rates, and access to skilled qualified FTEs. Constantly building a pipeline of qualified candidates who are added to databases for both current and future assignments using social media, job sites, networking events can be practiced internally. Resource management platforms that source, train, and deploy new talent into the clinical research industry globally, at scale, can also help in mitigating the problem. These tools can help bring Gen Z personnel at the bottom of the labor pyramid into the industry to expand the talent pool, hence reducing the supply-demand gap.